Daily Revenue and Deposit Reconciliation

This report provides information for use in cash accounting.

- Report Overview

- Journal Entries Report

- Summary Report

- Printing the Report

- Frequently Asked Questions

Report Overview

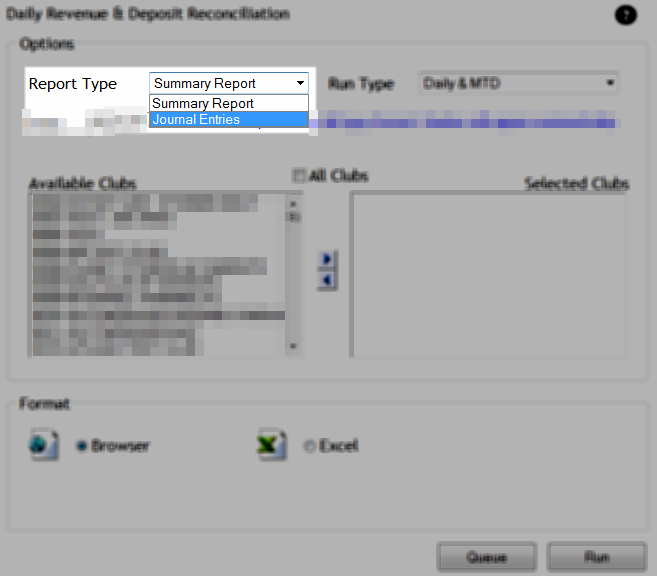

The Daily Revenue and Deposit Reconciliation report is available in two report formats. Choose the Summary Report format to view an extensive report showcasing information on revenue, deductions, interclub payments, pre-pay liabilities and redemptions, and deposits, with member-account-level detail available through several drill-down reports. Choose the Journal Entries report type to view vital information translated into journal entries that can be used to assist in reconciliations.

From the parameters page, you can select the report format and set other parameters, such as date and clubs to be included. The report will be generated based on the parameters you set.

This report uses information collected from DataTrak. It is only available for clubs using DataTrak.

Membership types presented in detail reports are presented as live data. This information does not depend on the membership type during the selected time period and, instead, will represent the most recent membership type on file.

Learn more about each report format below.

Reconciliation of the prior month can be begin on the 3rd day of the following month. This is due to EOM processing time in order to finalize deductions.

Users have two options for obtaining the finalized Daily Revenue and Deposit Reconciliation report. It can be pulled manually via Club Reporting System on the morning of the 3rd, or received automatically via email. Please contact your ABC representative to set up automated delivery.

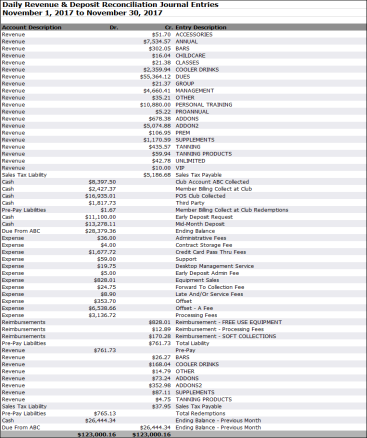

Journal Entries Report

The Journal Entries report translates vital information found in the summary version of the Daily Revenue and Deposit Reconciliation report into journal entries that can be submitted into the club's accounting system as well as used to assist in reconciliations.

You can view a sample of the Journal Entries report below.

Summary Report

This report provides information on revenue, cash, and ABC expenses for use in cash basis accounting but not in accrual basis accounting. It can also be used to assist in cash reconciliations.

The POS and Club Account columns do not include non-cash payments types (such as pre-pay, write-offs, and gift cards). Non-cash payment types are only included in the Billing columns.

You can generate the report to include data from one of three date range options, daily only, month-to-date (MTD) only, or daily and MTD. The samples below will include daily and MTD figures for the following indicators:

- Revenue by Payment Type

- Revenue by Profit Center

- Deductions

- Revenue Analysis

- Deposited Member Billing

- Deposited Club Account

- ABC Club Account Reconciliation (Collections less Deposits)

- Interclub Payments

- Pre-Pay Liabilities and Pre-Pay Redemptions

Click here to view a sample report.

Payments made at club are included in the Member Billing Collected at Club and Third Party sections of the report. Payment dates reported for payments made at club are the dates that the ABC billing system processed the payments. If the payment was made via DataTrak, the payment date could be different than the date recorded in the billing system.

Aggregate Report Navigation

Hyperlinks leading to drill-down reports are only available in single club reports. If you run the report for multiple clubs, you can quickly access individual club reports. For instructions on how to switch to a single club report from the aggregate report, click

Once the single club report is loaded, you will have access to hyperlinks.

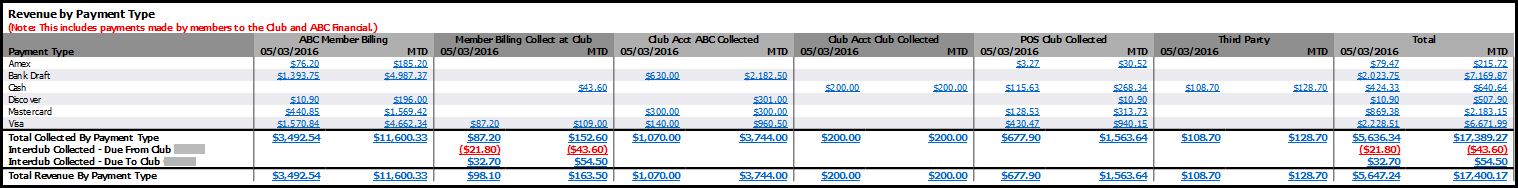

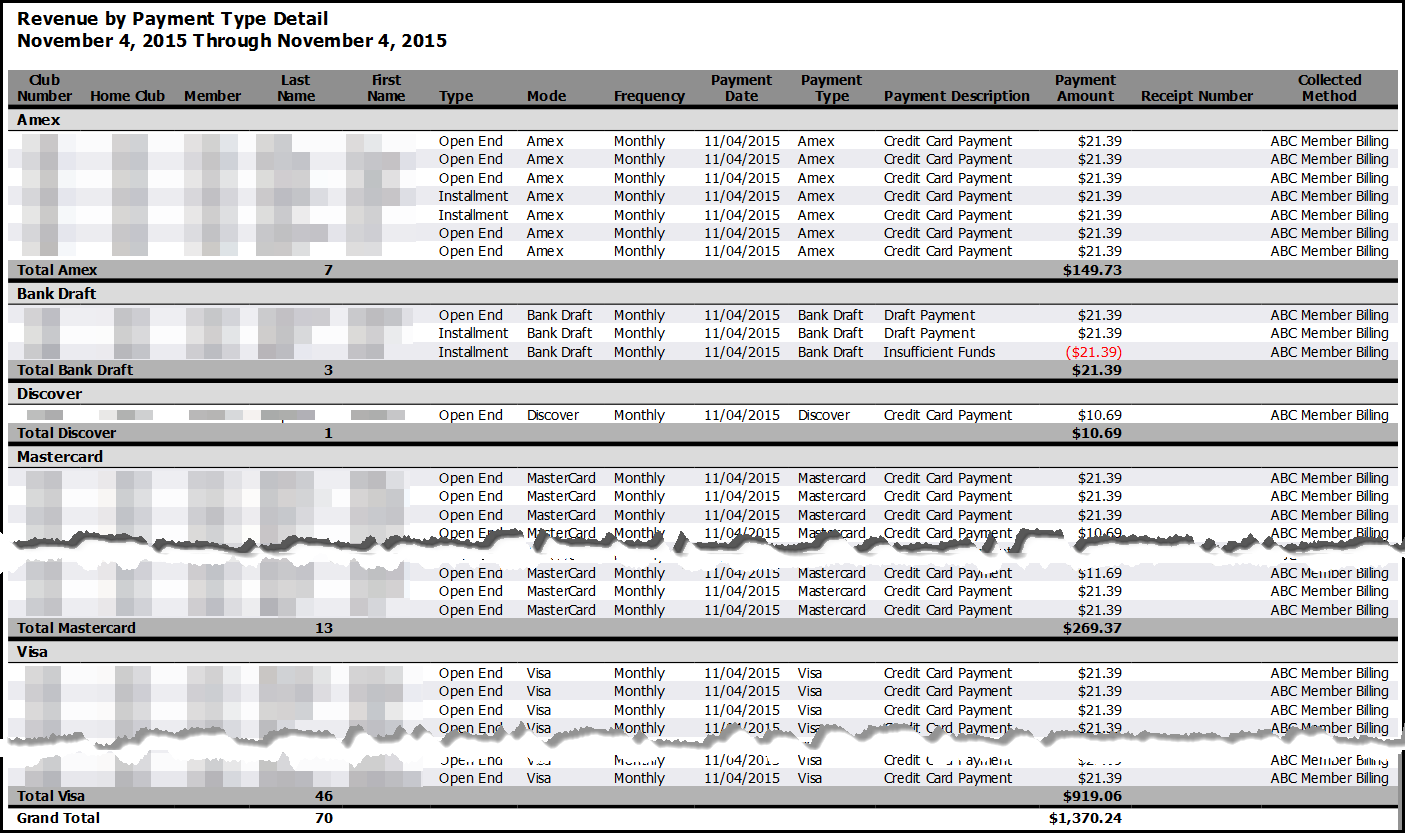

Revenue by Payment Type

This section displays total collected by payment type for each revenue stream.

| Row | Description |

|---|---|

| Interclub Collected - Due From Club #### | Money collected in the club for non-home club members. This row is only populated for the Member Billing Collect at Club section. This information is not available in an aggregate report; you must select a single-club report to view the data. This row will not be displayed unless interclub payments occurred during the selected time frame. |

| Interclub Collected - Due To Club #### | Money collected outside of the home club for the home club. This row is only populated for the Member Billing Collect at Club section. The row will not be displayed in aggregate reports. The row is also not displayed when there are no interclub collections for the selected time frame. |

| Total Revenue by Payment Type | This total represents club revenue collected at the home club and at other clubs for the home club. This row is not available in aggregate reports. The row is also not displayed when there are no interclub collections for the selected time frame. |

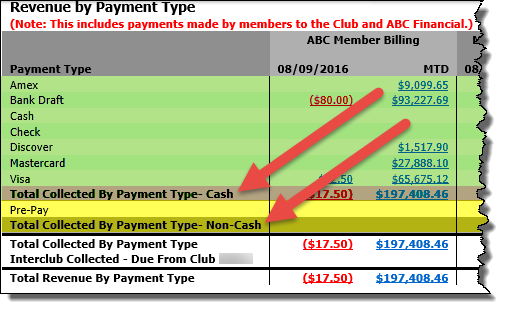

Cash and non-cash payment types are displayed separately in the Revenue by Payment Type section. Non-cash payments include pre-pay, write-offs, and gift cards. If non-cash payment types were not used during the time period selected, the non-cash and cash payment types subtotals will be suppressed from the report.

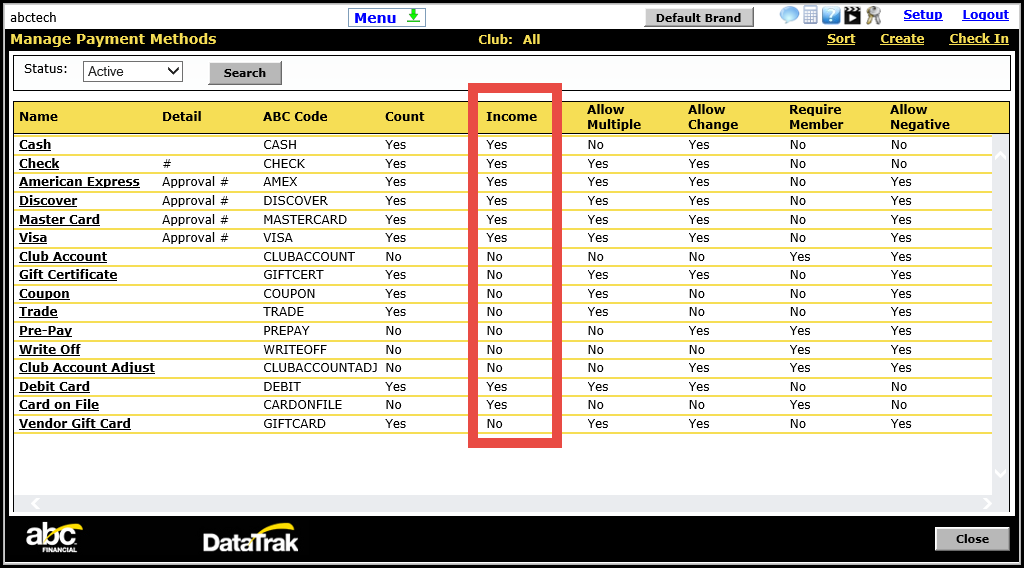

For cash and non-cash totals to be accurate, all DataTrak payment methods must be correctly set up as income (cash) or non-income (non-cash).

Ensure that these settings are correct by signing on to DataTrak and checking Payment Methods settings (located under the Point of Sales section of the Setup menu). The Income column displays this information, as displayed below.

To correct this information, click a payment method name and edit the income setting. If this information is not available to be edited, call the ABC help desk for further assistance.

Please note that split payments will only be classified as non-cash payments when they are covered completely by non-cash payment types. Split payments will be classified as cash payments when even a portion of the payment consists of a cash payment type.

You can drill to member-level details by clicking a hyperlink.

For example, when you click a revenue source total, you can access data specific to that source grouped by payment type, as shown below.

Interclub payments1 are included in the totals shown at the Revenue by Payment Type summary level but are not included in drill-down reports. Accordingly, totals may differ slightly between the summary and drill-down reports. To account for the difference, see Interclub Payments. This difference occurs because transaction-level details are only available for member accounts associated with the selected club(s) due to information security protocols.

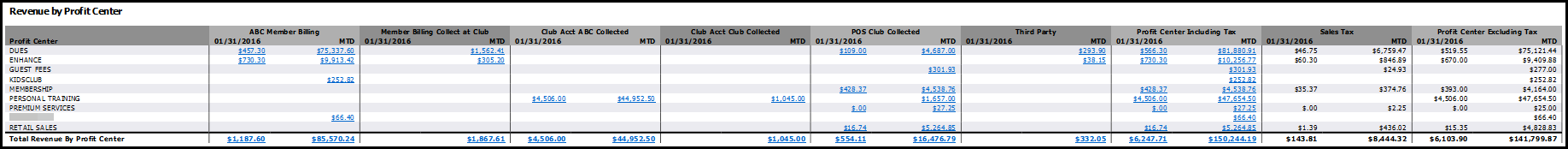

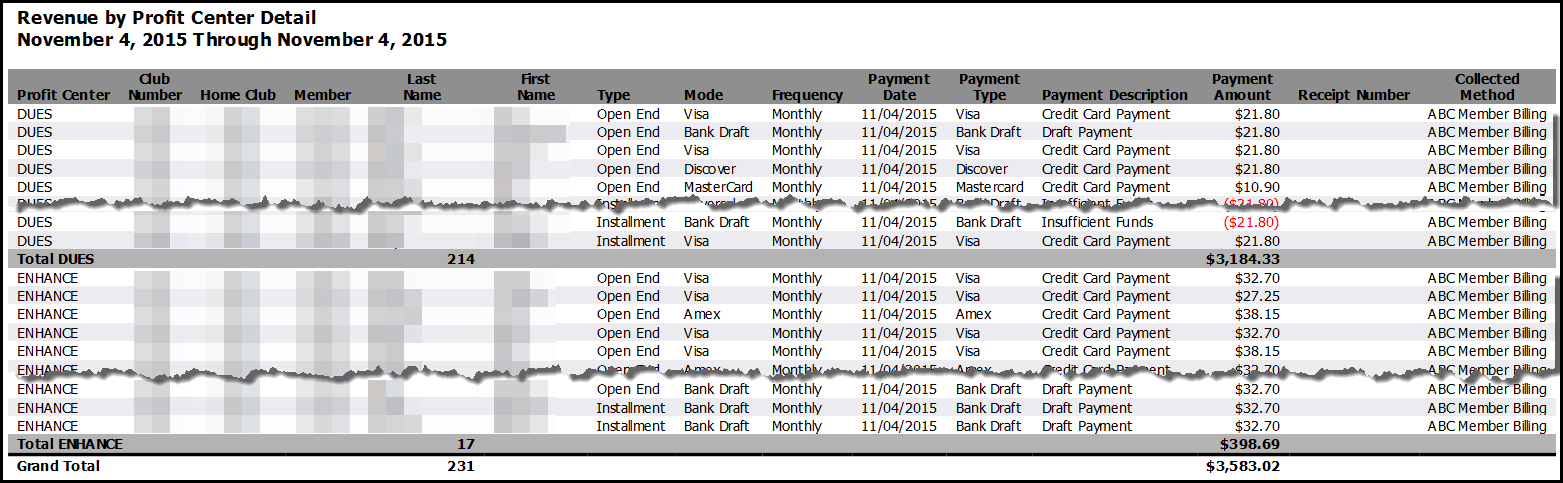

Revenue by Profit Center

This section shows total collected by profit center for each revenue stream. Payments made at the home club and other clubs for home club members are included in this section. Interclub payments are not included in this section.

The Revenue by Profit Center section includes an analysis of Revenue by Payment Type Less Revenue by Profit Center. Totals for the section will be zero unless the Revenue by Payment Type section includes interclub payments.

Click any total formatted as a hyperlink to view related transaction-level details.

The Daily Revenue and Deposit Reconciliation report represents profit center assignment as it was set up at the time of the transaction. Updates to profit center assignment will not be retroactively applied.

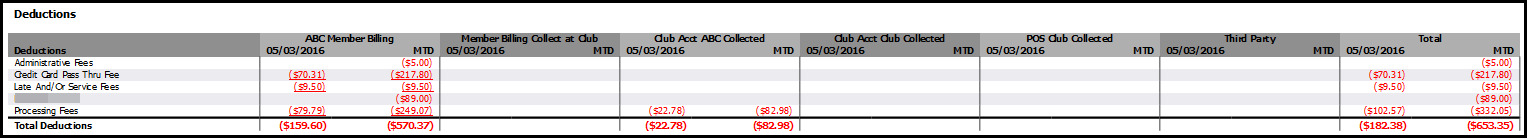

Deductions

Use the Deductions section to view how processing fees, early deposits, credit card pass through fees, and administrative fees were applied.

Drill-down reports are provided for processing fees, late and/or service fees, and credit card pass thru fees.

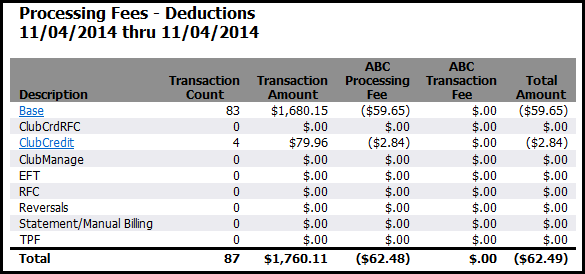

Processing Fees

View transactions count, transaction amount, and associated fees to arrive at total processing fees assessed.

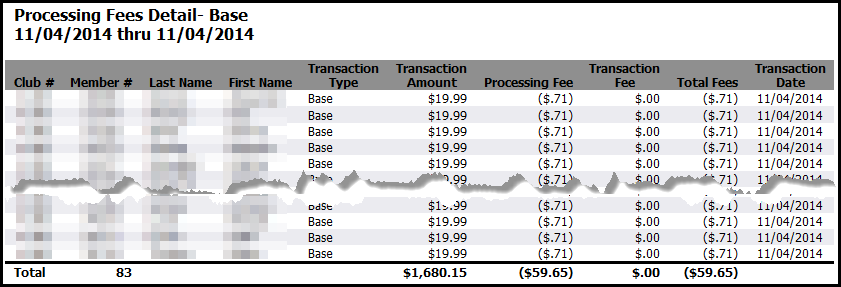

From the Processing Fees report, click a description formatted as a hyperlink to generate transaction-level data. For example, the Base drill-down report is shown below.

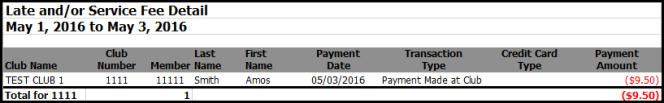

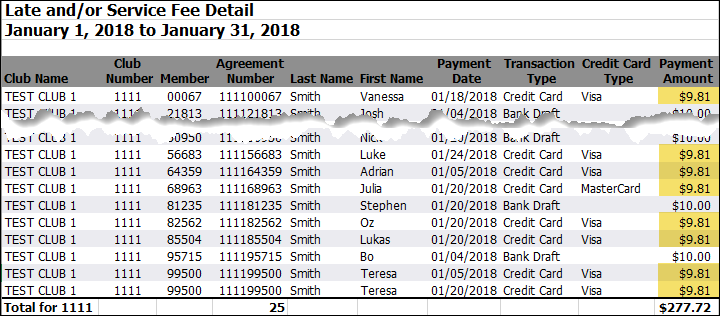

Late and/or Service Fees

View late fees and service fees for the time period selected.

Reimbursed Late and Service Fees will reflect amounts net of Credit Card Pass Thru Fees. In the example below, a Credit Card Pass Thru Fee of 19 cents has been deducted from the payment amounts highlighted.

Data for the Late and/or Service Fee Detail report is available from February 2016 forward.

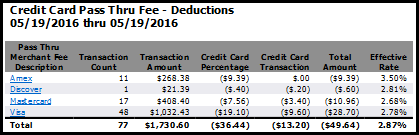

Credit Card Pass Thru Fees

View credit card pass thru fees by payment method.

| Field | Calculation |

|---|---|

| Effective Rate |

Effective rate is found by dividing credit card fees by total credit card volume. The effective rate only accounts for ABC member billing transactions; payments made at club and third-party RFC collections are not included. The effective rate will be calculated for transactions that occurred on or after March 1, 2016. |

| Total Effective Rate |

The total fee percentage is calculated by dividing the sum of all payment service fees by the total value of all transactions for the statement period. The total effective rate is available for merchant statements from April 2016 forward. |

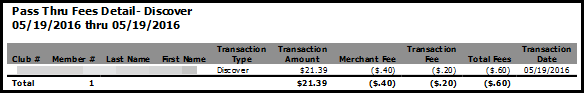

Click a payment method to view transaction-level details. The Discover Pass Thru Fees Detail report is displayed below.

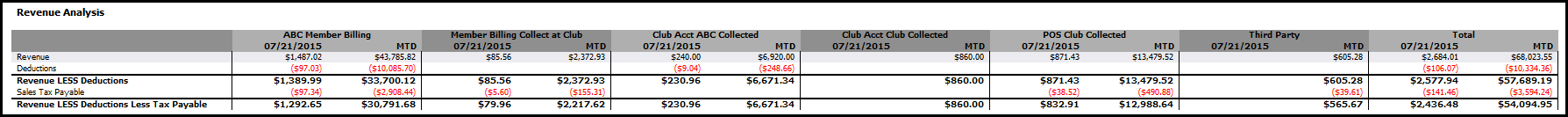

Revenue Analysis

View revenue after deductions and sales tax are applied.

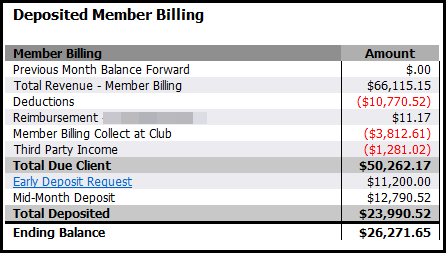

Deposited Member Billing

This section displays the total due to the client less previous deposits made for the selected month. The Ending Balance To Be Deposited is provided alongside the date when the balance is available for deposit.

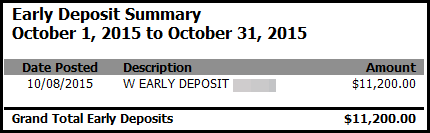

Click Early Deposit Request to view the Early Deposits Analysis, shown below.

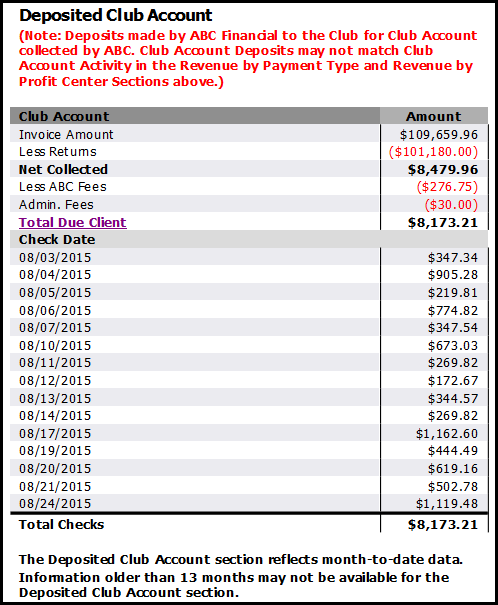

Deposited Club Account

This section displays the total revenue collected less processing fees and returns for ABC-managed club accounts.

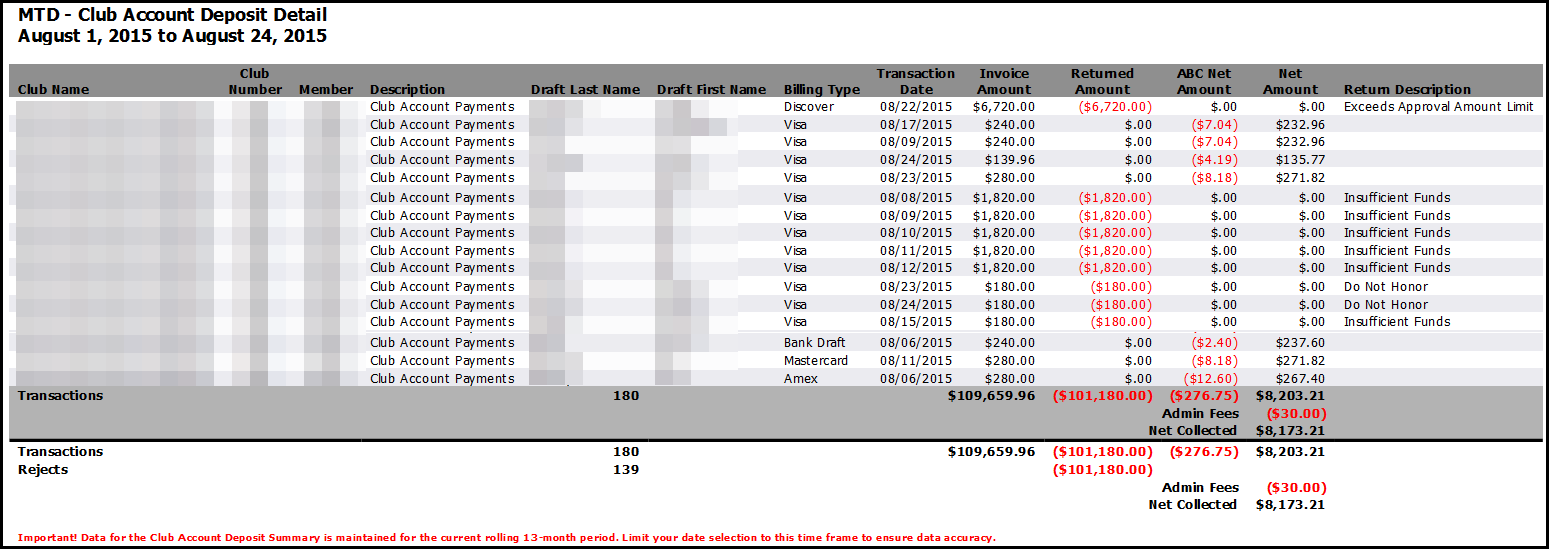

Select Total Due Client to view the Club Account Deposit Detail report.

The Club Account Deposit Detail report is shown below.

Note About The Deposited Club Account Section

The figures in this section may differ slightly from club account totals in previous sections. Differences occur when

- fees are accounted for. The Deposited Club Account section displays net collected after fees and returns are incorporated. Other sections of the report represent gross collected.

- transactions from the previous month are included. ABC does not deposit funds on weekends or holidays; some deposits may include transactions from the previous month. Other sections of the report record transactions based strictly on the date of transaction.

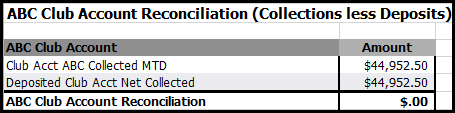

ABC Club Account Reconciliation (Collections less Deposits)

Use ABC Club Account Reconciliation to understand differences between collections and deposits.

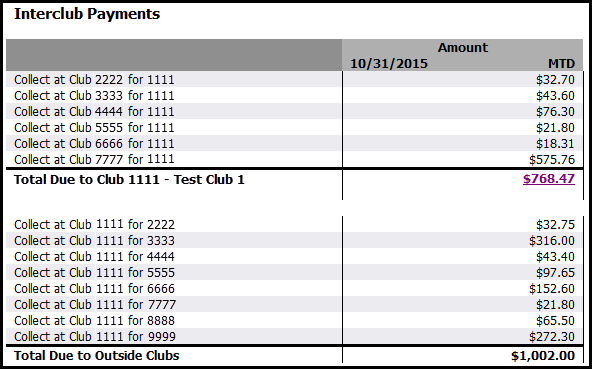

Interclub Payments

View what is owed to the selected club as well as what the selected club owes to other clubs.

Click the Total Due link to generate transaction-level data displaying funds collected by other clubs for the selected club or funds collected by the selected club for outside clubs.

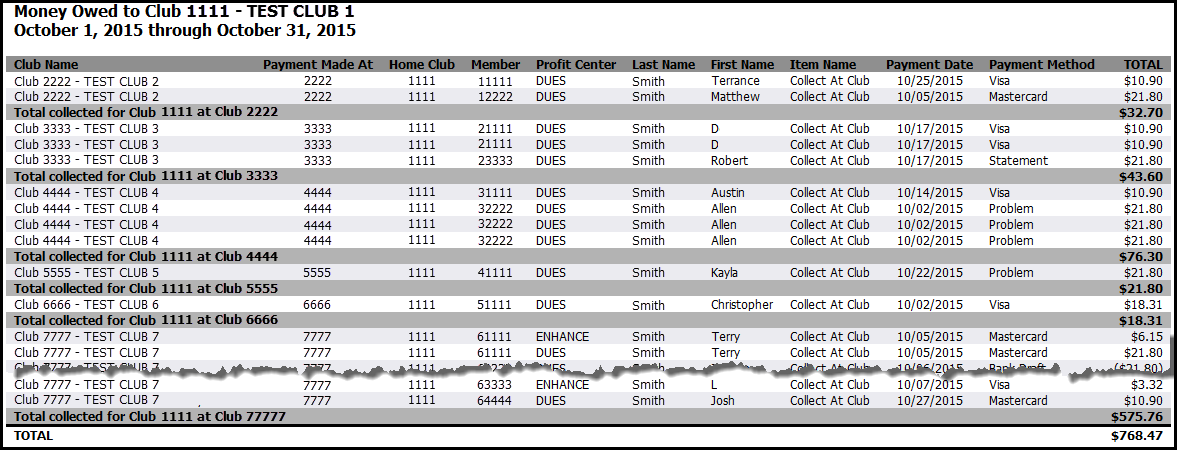

Here is a sample of the Money Owed to Club drill-down report.

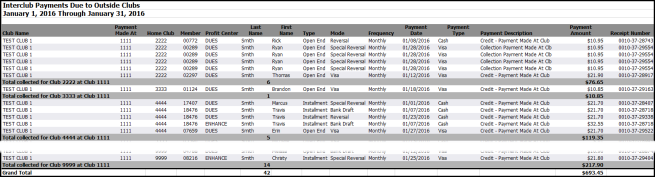

Here is a sample of the Interclub Payments Due to Outside Clubs report:

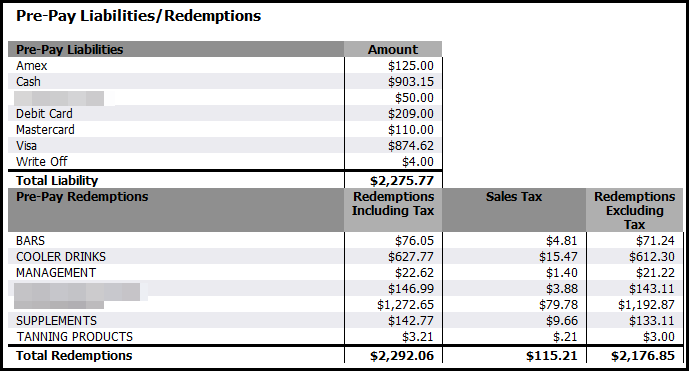

Pre-Pay Liabilities and Pre-Pay Redemptions

When members have pre-paid club accounts, you can use this section to track the increase and decrease of liabilities as pre-paid account balances are redeemed.

The Pre-Pay Liabilities portion shows club account totals organized by payment type. The Pre-Pay Redemptions section displays club account redemptions by profit center.

Pre-Pay Liabilities can include multiple forms of payment, including gift cards.

Printing the Report

To print the Summary report, generate the report in PDF format. In PDF format, each report section spans one page.

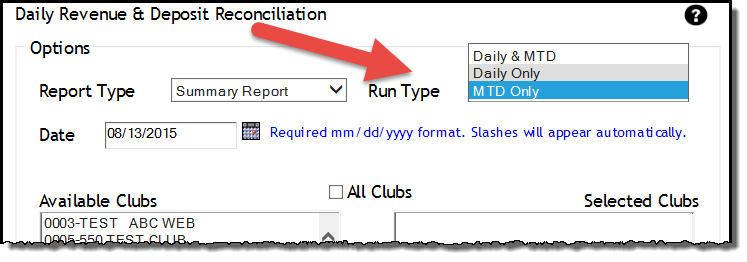

PDF format is available for MTD Only or Daily Only run types. You can specify Run Type from the parameters page, as shown below.

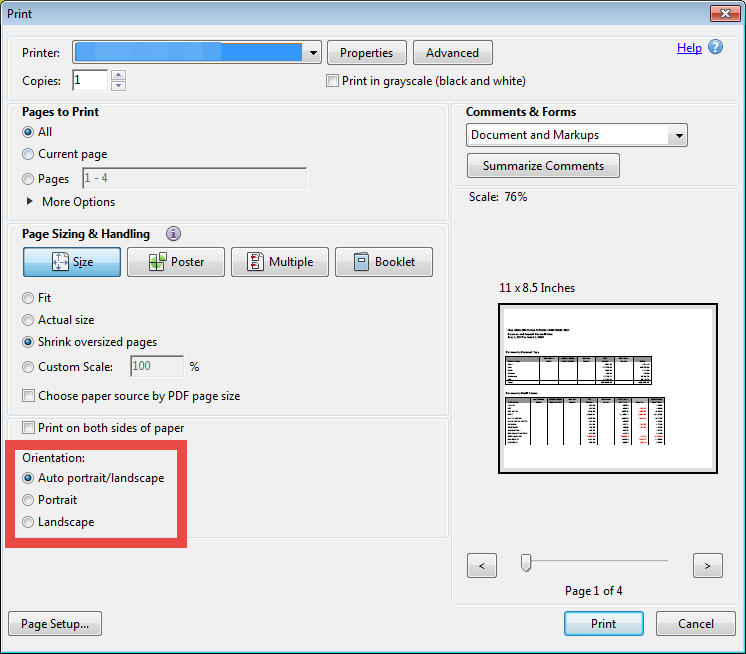

Once the report has loaded, be sure to set the orientation to Auto portrait/landscape when printing. To check this setting, select Print. Under Orientation, select Auto portrait/landscape, as indicated in the image below.

Once your selections have been made, click Print.

Frequently Asked Questions

Why are non-cash (pre-pay, gift certificate, coupon, etc.) payments not showing in the Revenue by Payment Type section of the report?

The report is set up for cash accounting and does not include these transactions for the POS and Club Account columns. This information can be found in the POS Revenue and Collections Summary and the Club Account Sales and Collections reports.

Why don't the POS and Club Account amounts on the Daily Revenue and Deposit Reconciliation report match POS Revenue and Collections Summary or the Club Account Sales and Collections reports?

The POS Revenue and Collections Summary and Club Account Sales and Collections reports include non-cash payment types (pre-pay, gift certificate, coupon, etc.). The Daily Revenue and Deposit Reconciliation report excludes non-cash payments for those sections as it is intended to be a cash accounting report.

Why doesn't this report match Integrated Sales Tax?

The Integrated Sales Tax report shows sales and the Daily Revenue and Deposit Reconciliation report shows cash collections. Some sales are not collected in the same month that the sale occurred, but the sales tax is calculated for that in Integrated Sales Tax. The Daily Revenue and Deposit Reconciliation report will only show the transaction once the payment is made.

Why does Total Collected match between the Daily Revenue and Deposit Reconciliation and Monthly Billing Statement, but individual profit centers have variances?

The Daily Revenue and Deposit Reconciliation report is created from daily snapshots and shows all transactions as they looked on the day that they occurred. When a transaction is updated after the fact to be placed in a different profit center, the Monthly Billing Statement will capture the new Profit Center, but the Daily Revenue and Deposit Reconciliation report does not change the historical information.

Can I just receive the Revenue by Profit Center information via the automated reporting system?

Yes! To have the automation set up, please complete the automated report setup checklist and submit it to ABC on the ABC CRS Client Request Form.

Are interclub payments deposited to the home club?

No. Interclub payments are not deposited to the home club.