Integrated Sales Tax by Source

- Report Overview

- Sources

- Profit Center Amounts

- When to Use This Report

- Excel Formulas

- Sample Report

- Unassigned Sales Tax

Report Overview

The Integrated Sales Tax by Source combines DataTrak POS sales tax information and ABC Billing sales tax information in the same report. It breaks out the information by profit center and by tax type.

The report is on the CRS Combined tab.

Configuring

your data for the Integrated Tax reporting

Contact your

Account Executive to have your ABC Billing information configured for

Integrated Tax reporting.

Sources

The report categorizes items by source and then by profit center, and subtotals the values for each source. Here is more information about the two sources:

- ABC Billing: contains information from billing systems.

- POS:

contains information about a sale or payment made through the DataTrak

POS system, including

- ABC Collected Club Account

- DataTrak Merchant Services

- DataTrak Point of Sale

Amounts

Each profit center includes the amounts described in the table below:

| Column | Description |

| Total Collected Amount | Displays the gross value of payments made at purchase, including sales tax collected, whether the sale was of a taxable or non-taxable item. This sum also includes any voids or reversals. |

| Taxable Amount | Displays the sum of the gross value of purchases designated as taxable, including tax collected. This sum also includes any voids or reversals. |

| Non Taxable Amount | Displays the sum of the gross value of purchases designated as non-taxable, including voids and reversals. |

| Tax Amounts by Tax Category |

The sales tax collected for tax categories your club has defined in DataTrak. |

Transactions are reported in the month in which they take place. For example, if a sale on January 31 was reversed on February 2, the sale would be reflected on January's report and the reversal on February's.

When to use the Integrated Sales Tax by Source report

Here are some situations in which you may want to use the Integrated Sales Tax report:

- To see your taxes broken out by tax category

- To see a combined view of sales tax for both DataTrak and ABC Billing

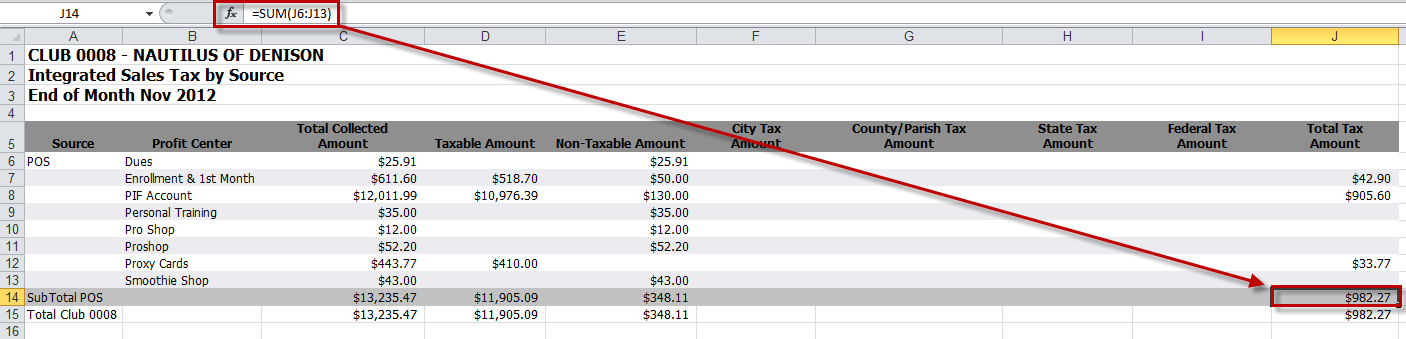

Excel Formulas

The Integrated Sales Tax by Source report, when delivered

in Excel format, includes formulas in its subtotal and total lines.

Click to see a sample of this report in Excel format.

This

example highlights the formula used for the POS subtotal:

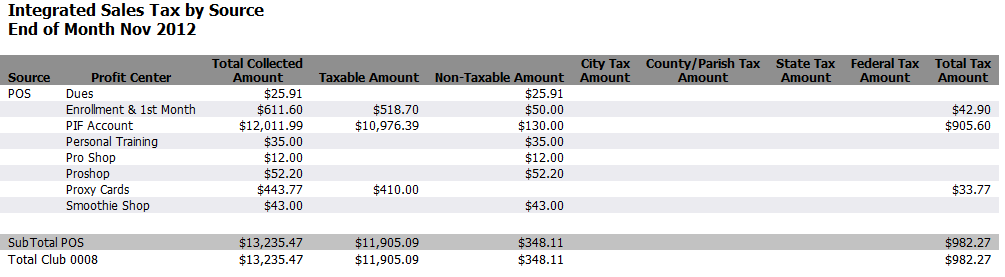

Sample Report

Click to see a sample of this report.

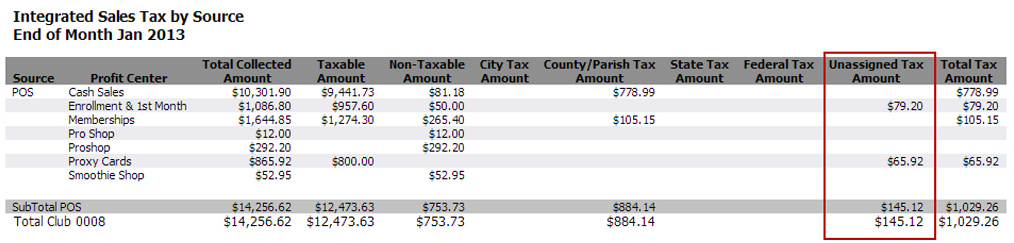

Unassigned Sales Tax

If you see any amount in the Unassigned Sales Tax column other than $0.00, this is an indication that sales taxes have not been properly configured. If this is the case, the Integrated Sales Tax by Source Report will not be as useful as it could be, since the report will not show how Unassigned Sales Taxes should be allocated.

Please contact ABC for assistance in configuring sales tax for your club:

Client Services

Toll Free: (888) 622-6290

Fax: (501) 992-0803

Email: [email protected]